Q4 2023 Newsletter

Opportunities & Obstacles in 2024

Ken Forster

As a Mixed 2023 Comes to a Close, Opportunities, and Obstacles Loom in 2024

Exciting news at Momenta! This quarter, we welcomed Rockwell Automation as an anchor investor in our fourth Industrial Impact fund, a $100m venture capital fund focused on Industry 5.0.

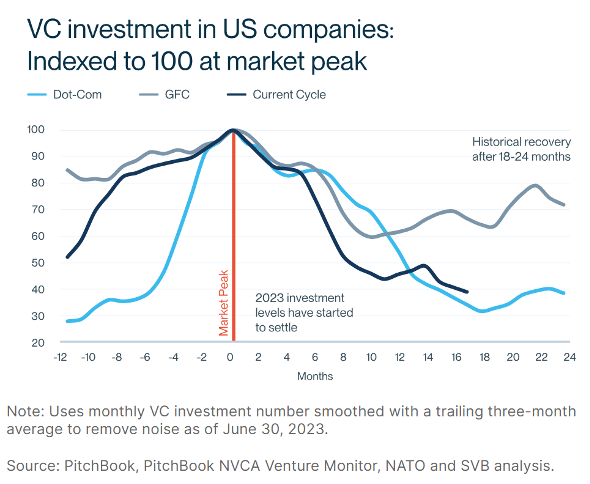

The final quarter of 2023 saw a robust recovery in public markets, with equity rallies retracing year-to-date gains in the major stock indexes following a difficult 2022. V.C. investing appears to be recovering, albeit slowly. According to C.B. Insights, global venture funding in 3Q23 increased 11% from 2Q to $64.6 billion. Notably, average and median deal sizes continue to trend down from 2021 highs. SVB’s analysis shows V.C. investment reaching a floor 12-18 months into a down cycle, with the current environment showing signs of stabilization prior to an upturn. KPMG sees V.C. deals taking more time to close as investors perform deeper due diligence and expect a gradual improvement into next year.

The global IPO market also showed signs of improvement in 3Q23, with 126 companies going public in the quarter, an increase of 24% from 2Q. However, the V.C. fundraising environment remains challenged in 2023. According to an SVB forecast, U.S. VC funds are expected to raise roughly $70 billion in 2023, down 50% from 2022.

Threading the Needle – Economic Slowdown vs. Easing of Rates

2023 has seen a balancing act as central banks raised rates to tame rampant inflation, while fears of a recession fortunately did not materialize. With the U.S. Fed, the ECB, and Bank of England holding rates steady in December, the faster-than-expected declines in inflation and signs of cooling in the economy could lead to interest rate cuts in 2024, which would likely benefit equity markets, corporate borrowers, and more speculative investment classes including V.C. There’s still divergence in macro views, with one camp viewing a global recession as being delayed (not avoided), another seeing disinflation as a risk, and more bullish views calling for 2024 to be the year of a “soft landing.”

2023 Was the Year of Breakout A.I.

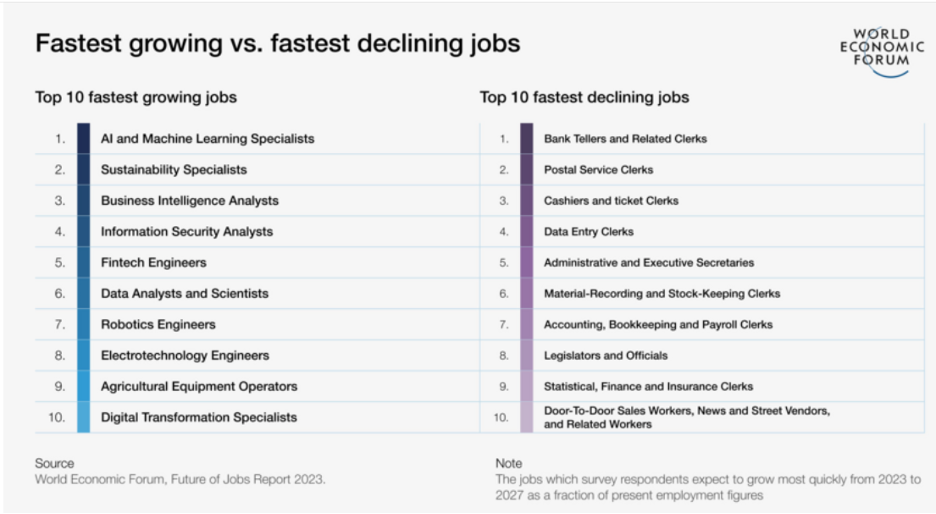

The past year has seen an inflection in Artificial Intelligence adoption, particularly around Generative AI, which underpins ChatGPT and other Large Language Model (LLM) based technologies. The explosion of interest and innovation around A.I. has resulted in a wave of new startups, with A.I. investments dominating the V.C. landscape. The rapid ascent of powerful AI has also catalyzed concerns about the disruptive impact of job displacement. At the same time, fears of potential misuse prodded the European Union to finalize the first significant effort to regulate the technology with the EU A.I. Act.

Looking Ahead: Tempered Optimism Prevails

The coming year portends opportunities and challenges ahead. Businesses must plan for an environment in which economic stability is tenuous; geopolitical risks remain elevated, inflation and energy prices are moderating but still volatile, where securing skilled talent remains complex, and cyber threats continue to loom. The following are key themes for digital industrial firms to consider for 2024:

- Prepare for an Accelerating Role of A.I. - The breakout of generative A.I. will drive a tsunami of innovation across industries in 2024, and there are enormous opportunities to leverage the technology to drive new business models. A recent PwC survey found that 84% of CIOs expect to use GenAI to support a new business model. Critical concerns around responsible stewardship, governance, controls, and ongoing practices should guide the adoption of GenAI. The financial impact is expected to ramp quickly - Deloitte predicts revenue uplift for enterprise software companies (in addition to the cloud providers of gen AI processing capacity) will approach a $10bn annual run rate by the end of 2024. Another study by PwC estimates A.I. could add up to $15.7tn to the global economy by 2030. One critical area of focus will be ensuring that data is AI-ready – master data management and data governance have become increasingly important, along with metadata management.

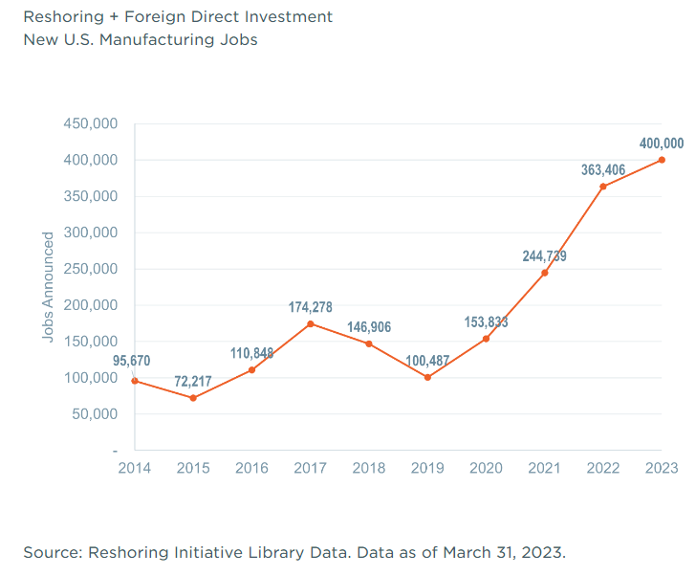

- Strengthen Supply Chain Resilience - The near existential pandemic-related supply chain shocks of 2020-21, the Russian invasion of Ukraine, and growing tensions between China and the West have underscored the importance of ensuring resilience against disruptions in the future. Recent incidents in the Red Sea have cut shipping traffic through the Suez Canal by half, threatening increased costs and delays in global trade. Part of this strategy includes reshoring manufacturing in developed countries. This has resulted in a significant boost to capex and new manufacturing jobs in the U.S., which also has implications for the tight labor market. Companies seeking closer to U.S. markets also make considerable efforts to move production and equipment to Mexico. However, the cost and complexity involved with re-factoring a global supply chain should not be underestimated, which could result in plans being scaled back over time. There are some skeptics in the extent of reshoring – Forrester estimates that 30% of Fortune 500 manufacturers will dilute plans to bring manufacturing home.

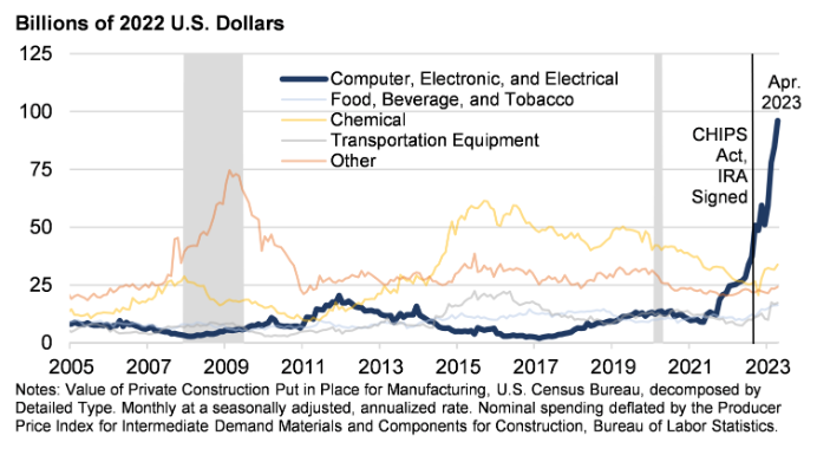

- Position to Benefit from Public/Private Investments in Infrastructure - The United States is seeing an unprecedented boom in the construction on manufacturing facilities – particularly computer, electrical, and electronic manufacturing - benefiting from reshoring efforts and policy-driven funding and tax incentives. Notably, the boom in construction is mainly US-centric, with spending levels in other major economies trending consistent with historical levels. Consequently, digital businesses will have opportunities to benefit from the upsurge in production capacity coming online.

- Anticipate Regulatory Demands - The recently finalized EU AI Act is not slated to go into effect until 2025, but developers and businesses will need to evaluate it. While it’s helpful to have a definition around which solutions will be regulated and to what extent, there will be resource challenges complying with new documentation and verification requirements, particularly for smaller firms and developers working on High-Risk category solutions. KPMG predicts that 2024 will broadly see regulators return to heightened risk standards, with “up-leveling” expectations with a broader focus on data, models, and “model-like” risks.

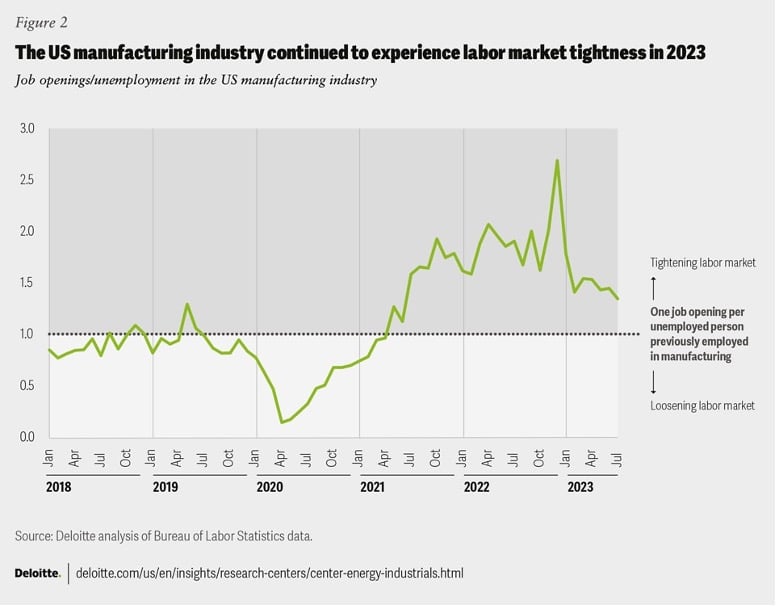

- Prepare for Challenges in Securing Talent -The labor market remained tight in 2023 and is expected to remain so in 2024, particularly for highly skilled workers. The tight labor market demands innovative strategies to attract and retain the workers and leaders needed for the future. Deloitte recommends that businesses increasingly utilize digital tools to enhance talent acquisition, tap into the knowledge of retirees (over 1/3 of manufacturing employees in 2022 were over 55), and focus on building and upskilling talent pipelines through collaboration with educational institutions and investment in training.

Making 2024 About Growth and Evolution

The year ahead promises a plethora of both incremental changes and consequential innovations. Some of the most thoughtful outlooks for digital industry practitioners come from PTC, IDC, The Manufacturer, Deloitte, Gartner, WEF, and the FutureToday Institute. At Momenta, we continue to invest in teams and technologies dedicated to pushing the innovative envelope in the digital industry. Some notable events in 4Q23 include investments in Minds.ai and Agtonomy, while we welcomed Rockwell Automation as an anchor investor in our Industry 5.0 fund. As always, we remain optimistic about the potential for technology and creativity to transform industry, the environment, and society at large.

See you in 2024!

Momenta is the leading Industrial Impact venture capital + growth firm. We accelerate entrepreneurs and leaders devoted to the digitization of energy, manufacturing, smart spaces, and supply chains. Since 2012, our team of deep industry operators have made over 100 investments in entrepreneurs and helped scale over 150 industry leaders via our award-winning executive search and strategic advisory practices.

Schedule a call to learn more about our Industrial Impact investments.