Digital Insights #60

ESG And Smart Spaces

Ken Forster

ESG And Smart Spaces

With the trend of increasing urbanization expected to continue (there are already 33 megacities worldwide with over 10 million inhabitants), the focus on sustainability, reduction of pollution, and energy efficiency will continue to be a priority – and the growing focus of investors on ESG will drive innovation and investment for years to come.

The Impact on Buildings, Cities, and Places

We've discussed how the ESG (Environmental, Social, and Governance) priorities of large institutional investors are compelling publicly traded companies (as well as those owned by Private Equity) to articulate commitments to ESG priorities. The impact is being felt across many industries, notably Energy and Manufacturing, which we have discussed earlier. The Real Estate sector broadly encompasses residential, commercial, industrial, and public spaces, touching nearly every aspect of life and work. The growing investment focus on ESG extends to Real Estate as an asset class.

Investors Focused on ESG for Smart Spaces

There is a growing range of investment products that are focused on sustainability and smart cities. Blackrock, the global asset manager, launched the iShares Smart City Infrastructure ETF, which aims to capitalize on the opportunities presented by the new generation of smart megacities offering sustainable ways of living in the wake of the global migration from the countryside to cities. MSCI, the global Index provider, created the ACWI Smart Cities Filtered Index, which aims to represent the performance of companies that are expected to derive significant revenues from smart solutions for urban infrastructure – and fund provider Lyxor has launched an ETF based on this index.

According to Deloitte, sustainability has become increasingly vital to real estate investors. The European Association for Investors in Non-Listed Real Estate Vehicles has developed Sustainability guidelines to help align investments with ESG criteria. The 2020 GRESB real estate assessment (an investor-driven global ESG benchmark and reporting framework for listed property companies, private property funds, developers, and real estate investors) sees increased participation (up 22% from 2019). This is evidence of growing interest in ESG criteria in the real estate sector, pointing to a lasting role that sustainability will play.

Significant Investment into Smart Buildings

They underpin the strategies of smart cities focused funds in the multi-year trend of investment in smart buildings, which leverage multiple themes including Cloud Computing, SaaS, Internet of Things, and ESG. One of the major issues at hand is that North American buildings waste up to 30% of the energy they consume due to lack of intelligence and technology. The way to address this is reduce waste, improve efficiency and carbon emissions with the use of technology to monitor, track and optimize energy usage. There is a significant multi-billion-dollar opportunity around smart buildings, illustrated by several market forecasts. Fortune Business Insights forecasts the smart building market growing at a 12.6% CAGR from US$43.7 billion in 2018 to $109 billion by 2026. Acumen Research and Consulting estimate the global smart building markets growing at a 15.3% CAGR from 2019 to over $160 billion by 2026, while Zion Market Research estimates the market will reach $62 billion by 2024.

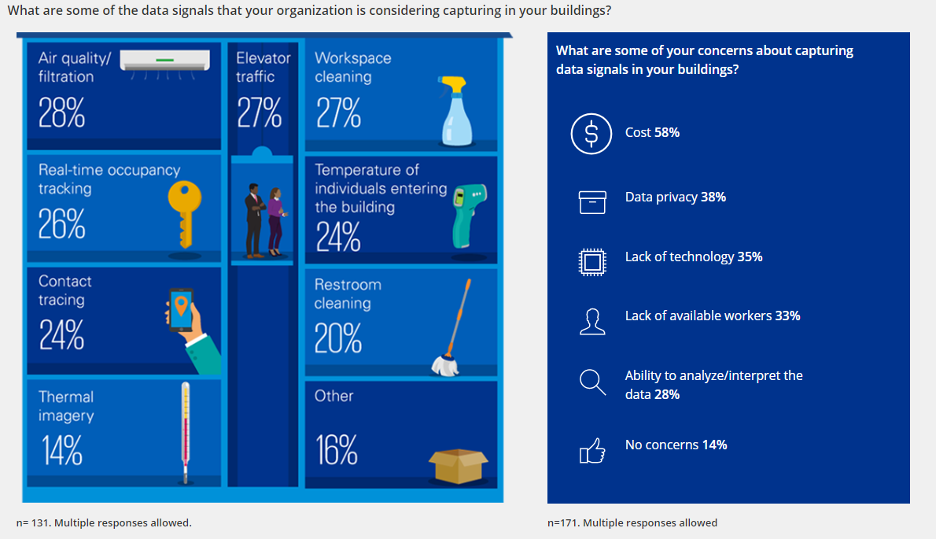

By applying technology to track and monitor data from buildings, insights from data can provide the basis for a broad range of optimization capabilities and enhanced services that not only save energy and reduce costs but can provide a better experience for tenants potentially driving enhanced value creation through increased customer satisfaction while addressing ESG goals as well. The KPMG 2020 Data strategy survey identified a number of ways that respondents look to create value through building data collection:

Source: https://advisory.kpmg.us/articles/2020/kpmg-data-strategy-survey-key-findings.html

Smart Cities Embrace ESG as Foundational

Another area where we are seeing ESG impact on real estate and infrastructure is through smart cities initiatives, where technology is applied in innovative ways to improve how city infrastructure is managed and organized more efficiently. Smart Cities address ESG goals in managing physical assets, community services and resources, public transportation and traffic, optimized energy consumption, water supply, waste management, and public safety. Cities can manage and optimize energy consumption through intelligent electricity meters, dynamic electricity prices, automatic street lighting, and instruments for observing and changing human behavior in response to external risks. According to Chordant, smart cities have the potential to generate $20 trillion in economic benefits by 2026.

Smart Cities initiatives are a global trend. Cities like Dallas are passing climate action plans, which include reducing emissions from buildings. Dallas has set a goal for all new construction to be carbon neutral by 2030. South Korea is one of the world's leading countries using smart city technology and has used the smart city data hub contact tracing system to fight the coronavirus outbreak.

With the trend of increasing urbanization expected to continue (there are already 33 megacities worldwide with over 10 million inhabitants), the focus on sustainability, reduction of pollution, and energy efficiency will continue to be a priority – and the growing focus of investors on ESG will drive innovation and investment for years to come.

Momenta is the leading Digital Industry venture capital firm accelerating digital innovators across energy, manufacturing, smart spaces, and supply chain. Led by deep industry operators across its venture capital, strategic advisory, and executive search practices, Momenta has made over 50 investments with notable exits to SAP, PTC, and Husqvarna Group.

Schedule a free consultation to learn more about our Digital Industry practice.