Digital Insights #58

ESG & the Energy Industry

Ken Forster

Investors Pushing Energy Sector to Adopt ESG Principles

We’ve highlighted the growing importance of ESG (Environmental, Social, and Governance) driving investment decisions as Millennials drive increasing inflows into funds based on ESG strategies.

As we have previously highlighted, the growing capital inflows are moving companies to elevate their ESG stories and characteristics to appeal to institutional investors. In no sector is ESG considered more impactful than energy. Traditional Oil and Gas companies are widely considered “brown” investments, with a perception that they reside at the bottom of the pack in environmental impact.

Institutional investors are also telling private equity firms that they won’t provide capital unless ESG requirements are met. The most prominent example is one of the world’s largest investment firms, BlackRock, whose CEO Larry Fink wrote a letter last year to CEOs of companies in BlackRock’s investment portfolio, stressing the importance of sustainability. They made the point that BlackRock would look to vote against any management and board of directors of companies that didn’t make sufficient progress on ESG initiatives. Other investors and private equity firms are making similar public statements. While there is a broad push for ESG focus and investments, there remain skeptics of the long-term practicality of ESG focused strategies given the mixed record of returns. With viable arguments on both sides of the issue, it will take time for consensus to emerge on how deeply embedded ESG principles will persist in the investment community and in industry.

With a shortage of “green” and investable companies, ESG funds are casting a wider lens in order for businesses that offer both solid fundamentals, but that also can articulate stories of evolution and/or digital transformation. Traditional investment research providers like Morningstar, as well as other brokers, are increasingly highlighting ESG factors in their reports, even highlighting how midstream Oil and Gas companies can fit within an ESG investment framework. There is a growing cohort of Exchange Traded Funds focused specifically on the energy industry, but there are limitations to the size and scope of such funds.

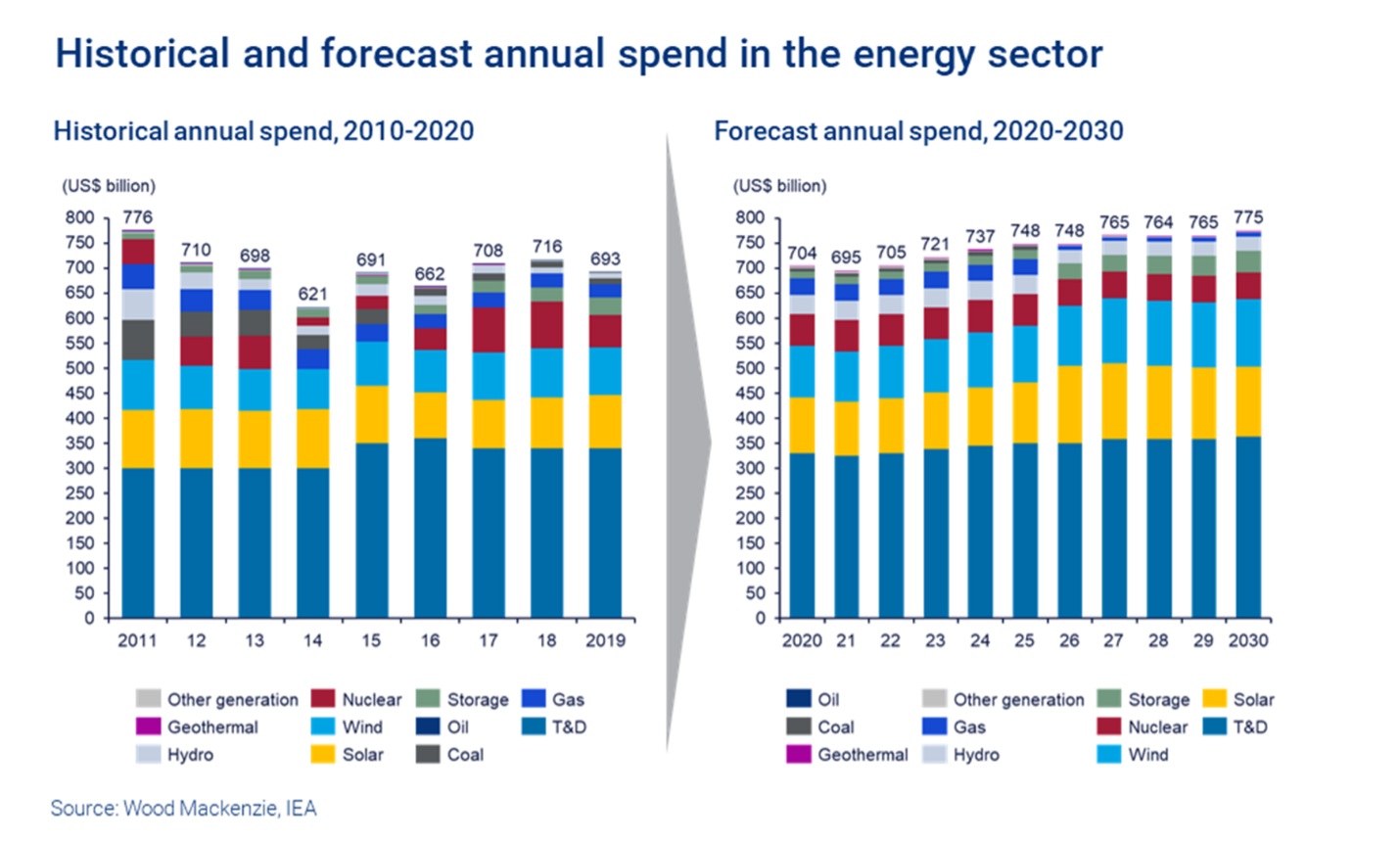

There is also a clear secular shift toward investing in clean energy, which is a multi-decade trend. While investments in wind and solar have tended to look flat at around US$200-250 billion a year, this flat headline spending masks the growing capacity of installations, as cost per kWh continues to decline. According to Wood MacKenzie, capital allocators should think about the cumulative installed base rather than the annual installed base.

Shifting Messaging to Appeal to ESG Investors

We’re seeing leading Oil and Gas companies articulating a shift in focus away from pure carbon-based fuels to broader-based “energy companies," and this is apparent in messaging. A Bloomberg analysis of quarterly earnings calls and other conference calls related to the 23 members of the S&P 500 Energy Index showed mention of ESG. Other sustainability-related terms soared in the first quarter of 2021 (compared to the same quarter last year). Use of ESG-related terms among oil and gas companies jumped from 36 in the first quarter of 2020 to almost 300 in the first quarter of this year.

The industry is working to address challenges. Several trade organizations, including the American Petroleum Institute, the Petroleum Equipment Services Association, and others, provide resources for members to implement and report on ESG initiatives. Currently, most companies are using SASB (Sustainability Accounting Standards Board) standards, which are helpful because they are industry-specific and investor-focused.

Private Equity firms are also getting involved in trying to help companies better fit into ESG investment frameworks. Kimmeridge, a private equity firm focused on the upstream oil and gas sector, published a whitepaper outlining five specific principles they believe should be adopted by companies they invest in. Those five principles included actions like eliminating flaring, reducing and monitoring methane GHG emissions, and ESG reporting. The organization OGEL (Oil, Gas & Energy Law Intelligence) has also published extensive research on the dynamics of ESG considerations in Oil and Gas deals

Technology Is the Key to Embracing ESG

For most energy firms, it’s clear that the embrace of technology is key to realizing ESG goals. Energy companies have been using technologies including artificial intelligence (AI), machine learning (ML), cloud, advanced analytics, the internet of things (IoT), big data, digital twins, drones, and wearables in their operations for uses like tracking and managing emissions, choosing the right portfolio of assets, and identifying renewable energy technologies that can provide sustainable growth. Software applications can also help address Social and Governance factors through better hiring, retaining, and/or training employees. The key for firms to continue to evolve (and to appeal to the increasingly important ESG focused capital) is to embrace transformation and technology to move ahead.

Momenta is the leading Digital Industry venture capital firm accelerating digital innovators across energy, manufacturing, smart spaces, and supply chain. Led by deep industry operators across its venture capital, strategic advisory, and executive search practices, Momenta has made over 50 investments with notable exits to SAP, PTC, and Husqvarna Group.

Schedule a free consultation to learn more about our Digital Industry practice.