Momenta's Take #34

Green Investing Goes Mainstream

Ken Forster

Green Investing Goes Mainstream

For investors, the clean energy sector has offered both opportunities and pitfalls – and prior cycles of booms and busts have left plenty of lingering skepticism. The term clean energy or “green technology” is broadly expansive, encompassing energy generation, storage, distribution, and other technologies including solar panels, batteries, wind, biomass, energy storage, smart grid, and other areas.

Some differences between green investment opportunities and the high-flying software companies of the latest IPO boom are capital intensity, the difficulties of hard science innovation, and the regulatory requirements of transportation and utilities. However, some of these hurdles are starting to lessen, and in turn, we are seeing an increase in sustainability-focused funds alongside major investments by traditional industrial firms to expand into renewables.

Millennials are Driving a Shift in Priorities

A new generation of investors is increasingly driven by more than just profits – millennials have been behind the growing emphasis on sustainability and positive social impact both within the workplace and financial markets. Millennials are prioritizing the importance of ESG (Environmental, Social, and Governance). A 2018 survey found that 87% of high net worth millennials prefer going through the company’s ESG before investing in it. 17% of millennials prefer investing in companies with high-quality ESG practices versus 9% of non-millennial investors.

Similarly, a 2016 survey found that 64% of millennials won’t take a job if a company doesn’t have strong corporate social responsibility values and that 83% would be more loyal to a company that helps them contribute to social and environmental issues. To put that in perspective, Millennials will make up over 75% of the workforce by 2025, making the issue too large to ignore.

The Rise of ESG Investing

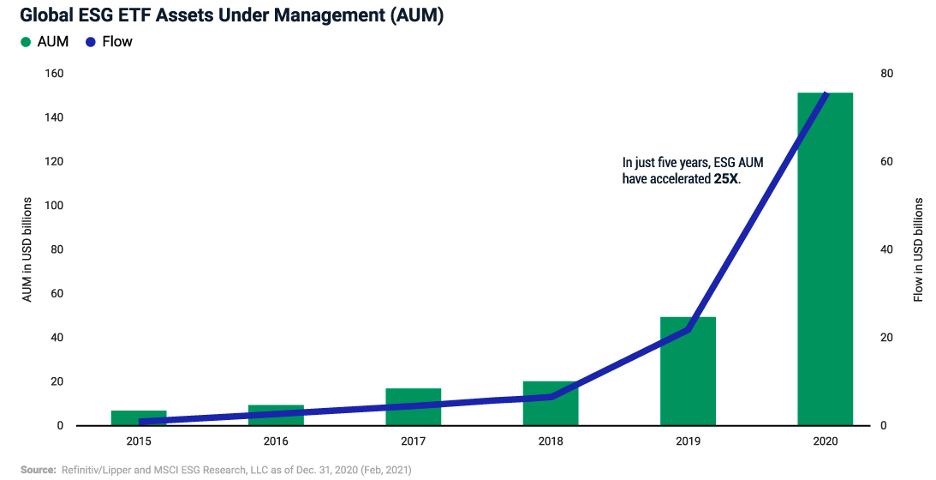

There is growing momentum around investing in ESG through specific companies, funds, and strategies. According to Refinitive/Lipper and MSCI ESG Research, investors allocated three times as many assets into ESG ETFs (exchange-traded funds) in 2020 than in 2019. Investors may look at the following factors (along with financial performance) in their ESG Strategies:

Source: Visualcapitalist.com

Global ESG ETFs have seen impressive inflows of funds, with assets under management (AUM) increasing from $6 billion in 2015 to $150 billion in 2020.

Growth is Expected to Continue

Bank of America estimates that in the next 20 years, there will be $20 trillion of asset growth in ESG funds.

Plenty of ESG Skeptics Remain

There’s plenty of ongoing debate about the efficacy of ESG measures used to drive strategies, and there are several challenges. One issue is the lack of consistent measurement standards to compare companies; another is the subjective nature of many criteria. While it’s easy to identify whether an industry is environmentally conscious (for instance, coal and oil companies are decidedly not “green”), it’s not necessarily a straightforward process to rate companies on a quantitative scale. One organization looking to address this gap is the CFA Institute, which has released a working draft of ESG Disclosure Standards for Investment products.

Another issue is whether the exclusion of specific industries from the universe of potential investments limits the potential for outperformance. A 2019 IBD/TIPP Poll found that in the context of a trade-off between a given ESG trait (safe work environment, fair employee wages, etc.) and return on investment (ROI), respondents favored ROI by a 2:1 ratio – which illustrates that a majority of investors are not willing to favor ESG if it means sacrificing returns. There’s a lot of discussion regarding whether the ESG investing boom is, in fact, a bubble. Though, in an aggregation of over 2,2000 empirical studies, 90% of studies show a non-negative ESG impact on corporate financial performance, many of those being positive.

Energy and Auto Going All-In on Renewables

On the corporate side, more and more industries are embracing both ESG principles in an effort to get ahead of investor, customer, and employee preference. Significantly, sectors such as automotive, heavy industry, and utilities are ramping up investments in sustainable energy – this is driven not purely by social or governance mission but increasingly by economics. The auto industry’s embrace of clean energy is well underway, with every major carmaker expanding its offerings of electrics and hybrids. GM has committed $27 billion, the most of any U.S. automaker, to expand its electric-only fleet, reflecting a profound shift in the company’s strategy. Most recently Ford introduced its new All-Electric F150, coming out in 2022.

Momenta's Take:

The rise of offshore wind power is giving rise to a different type of investment opportunity, repurposing of ships to install and service turbines. The number of active offshore wind turbines is expected to quadruple to 26,000 by 2030, nearly four times the current number, according to shipbroker Clarksons Platou – the value of the global fleet of service vessels was estimated to be €11 billion last year and must increase to €23 billion by 2025 to satisfy demand.

In a sign of the times, oil majors BP, Shell, and Total are expanding into supplying solar and wind power in order to pivot away from fossil fuels. Driving the expansion into sustainable energy is the rapid growth of corporate purchase agreements (businesses contract for multiple years for energy). Corporate procurement is a small part of the overall renewable power market, but it’s growing quickly. Corporate purchases of renewable energy grew 25% YoY in 2020, and new deals have increased 75% in the first four months of 2021.

Momenta encompasses leading Strategic Advisory, Talent, and Ventures practices with over 250 IoT leadership placements, 150 industry clients, and 50+ young IoT disruptors in our portfolio. Schedule a free consultation to learn more about our Digital Industry practice and services.