Momenta's Take: Global De-risking and Reshoring

Ken Forster

Supply Chain Resilience in the Face of Inflation and Operational Disruptions

The supply chain shocks at the height of the pandemic in 2020 were unprecedented in magnitude and scope. Inflation is running at 40-year highs, and high energy costs impact every step in the supply chain, from sourcing materials to delivering finished goods. In many industries, the types of shocks to operations that have occurred in recent years have the potential to wipe out 20% to 30% of yearly earnings.

While financial losses from supply chain losses dropped over 50% on average in 2022 compared to the prior year, challenges from shortages and delivery delays remain top of mind. Risk reduction has receded from being top of mind, however. According to PwC’s 2023 Digital Trends in Supply Chain Survey, only 30% of executives prioritize enhancing resilience as a critical goal when investing in supply chain technology.

Taking Steps to Reduce Supply Chain Risk

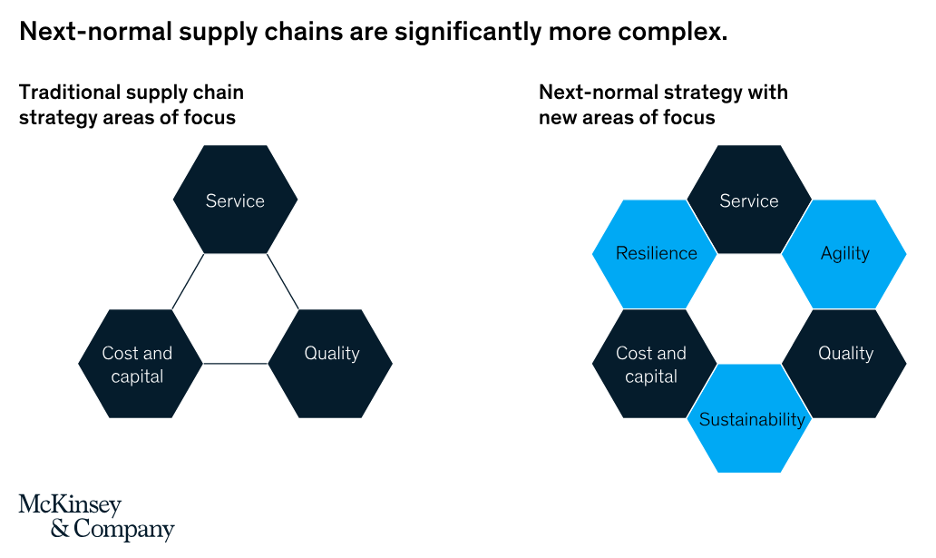

There are several levers that producers can use to reduce exposure, including de-risking components of the global supply chain and reshoring operations closer to home. Global de-risking refers to the process of companies diversifying their supply chains and reducing their dependence on a single source or location. Diversifying supply sources and sites minimizes the vulnerability of supply chains to disruptions. Companies can switch to alternative suppliers to maintain continuity if one source faces a crisis.

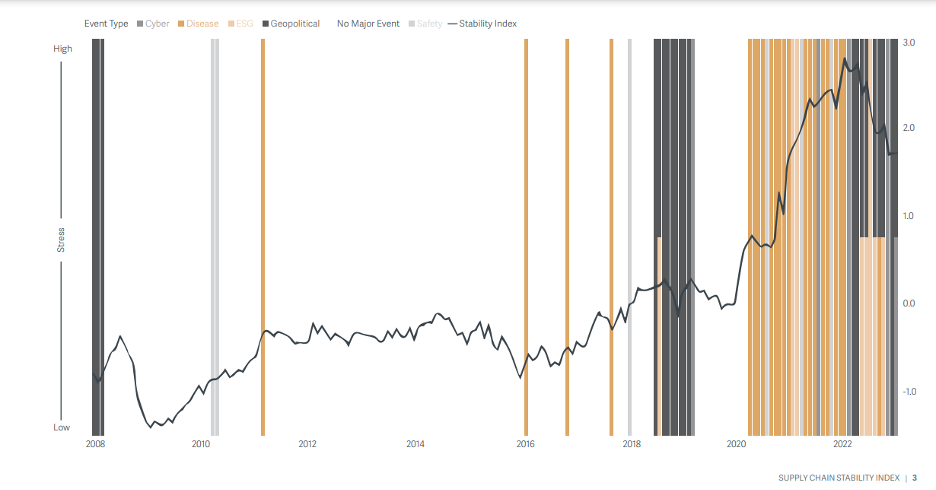

The emphasis of de-risking efforts has primarily centered on the U.S. and Western Europe reducing dependence on Asia, specifically China. According to the most recent KPMG Supply Chain Stability Index, reliance on China has dropped while Mexico and Canada are trying to exploit this opportunity.

1Q23 KPMG/ASCM Supply Chain Stability Index

v

Source: KPMG, ASCM

As of May 2023, Inbound container freight from Asia dropped 27%, while inbound air freight from Asia dropped 50%. De-risking the supply chain to improve resilience and agility does create new types of complexity, requiring additional resources such as investments in redundancy, logistics optimization, and risk management.

Bringing Production Closer to Home

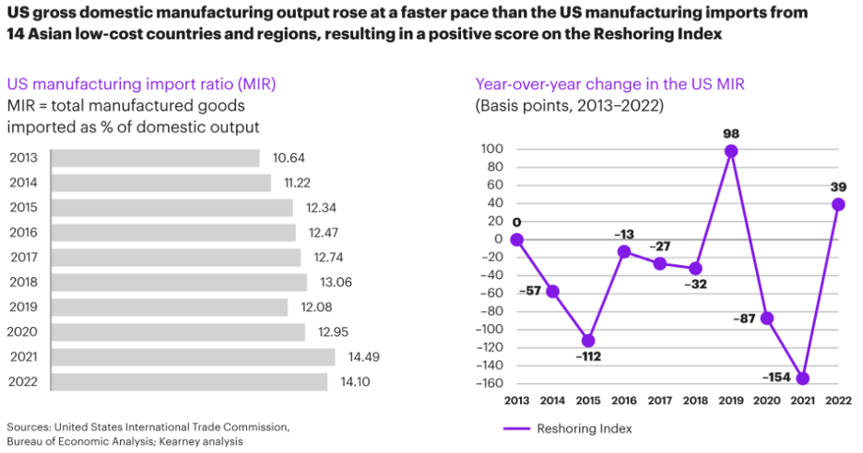

Reshoring involves relocating manufacturing or production processes to the home country from overseas. This has driven a surge of investment in manufacturing construction, which has increased by 80% over the past year versus a 6% increase for other non-residential buildings. Initiatives, such as the CHIPS and Science Act, focus on boosting U.S. production of semiconductors and other critical technology (roughly 90% of global semiconductors are produced in Taiwan, potentially vulnerable to Chinese military expansion).

Reshoring interest is nearly universal among Western companies: according to Kearney’s 2023 survey, 96% of CEOs evaluate reshoring their operations, have decided to reshore, or are already reshored – an increase from 78% in 2022.

Benefits of reshoring include shorter supply chains and increased control over quality, IP, and operational visibility. Challenges include higher costs and availability of skilled, specialized labor and infrastructure that may not be sufficient to support the needs of industrial operations. EY Industrial Supply Chain survey shows that 53% of respondents have already near or reshored some of their operations in the last 24 months, and 44% are planning new or additional near-shoring activities in the next 24 months.

Risk Reduction is an Investment

Businesses have become increasingly aware of the risks associated with dependence on a global supply chain based on just-in-time sourcing practices, labor cost arbitrage, and cheap, plentiful energy sources. Although unique pandemic disruptions have receded, the heightened awareness of potential risks drives businesses to assess and adjust to potential threats. According to IDC, nearly 55% of Global 2000 OEMs will redesign service supply chains using AI by 2026. De-risking and reshoring come with additional costs; however – businesses should view these activities as investments akin to paying for insurance. While the risks don’t go away, they can be mitigated – and the incremental benefits of resiliency and agility should more than offset the additional cost.

Momenta is the leading Digital Industry venture capital + value creation firm, accelerating entrepreneurs and leaders devoted to the digitization of energy, manufacturing, smart spaces, and supply chains. Since 2012, their team of deep industry operators has invested in 50 entrepreneurs and helped scale over 150 industry leaders via their award-winning executive search and strategic advisory practices.