Renewable Energy: Cost-Driven Adoption

Ken Forster

The Renewable Energy Transition: Are Declining Costs Accelerating Adoption?

Embarking on a global shift towards clean and renewable energy, supported by governments, NGOs, and investors, is no easy feat. While the journey is riddled with challenges and complexities, recent data unveils a surprising and consistent decline in the costs of renewable energy. This not only transforms the adoption of renewables into a financially savvy choice but also signals a future where the transition is not just a long and challenging road but one already making strides beyond expectations.

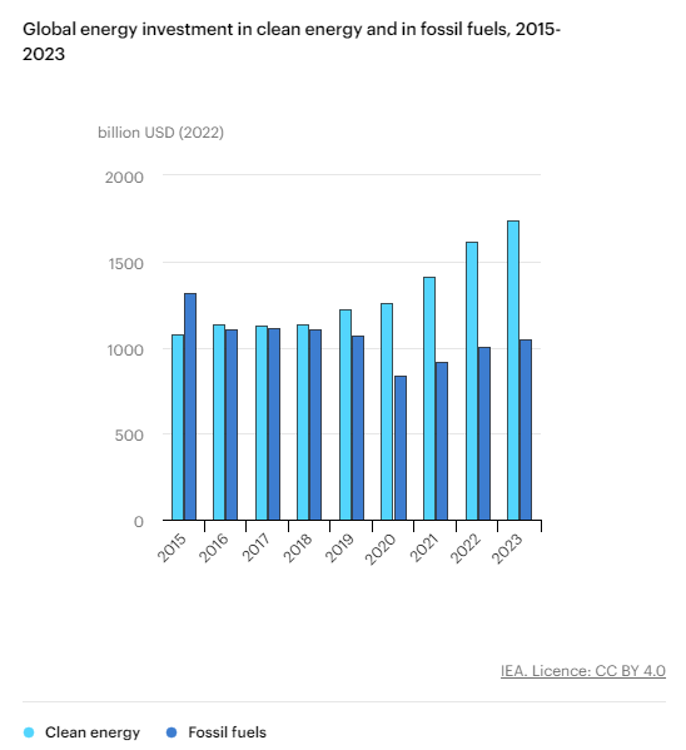

Investments Continue to Flow

Investment continues to pour into the clean energy sector. According to a report from Rhodium-MIT, there was $213 billion in new investment in manufacture and deployment of clean energy, clean vehicles, building electrification, and carbon management technology in the U.S. over the past year, representing a 37% annual increase. Five years ago, the investment in fossil fuels was approximately the same as in clean technology. According to the IEA, in 2023, for every dollar invested in fossil fuels $1.80 goes to clean energy – with total investment forecast to reach $1.8 trillion this year.

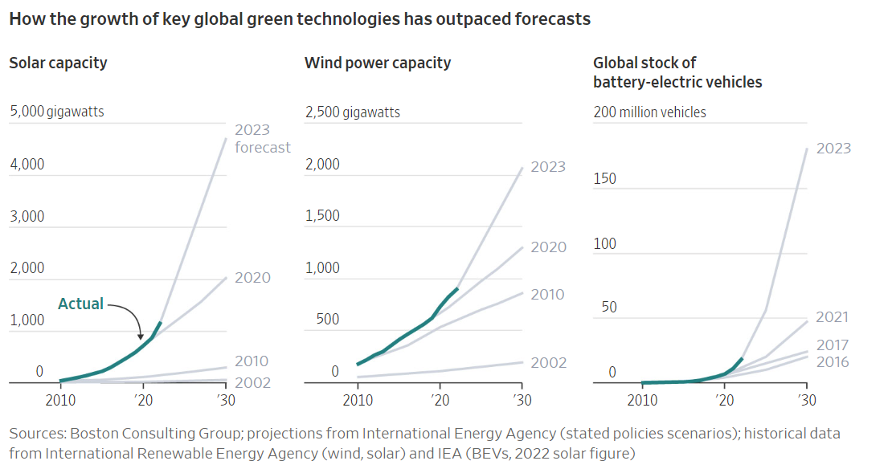

Consistently Underestimating the Pace of Change

One of the consistent trends in clean technologies has been the tendency of forecasters to underestimate the pace of adoption, and the cost declines as technologies mature. A recent Wall Street Journal article highlights this phenomenon as the adoption of solar capacity, wind power capacity, and the global stock of battery-electric vehicles vastly outpaced forecasts from 2002, 2010, and 2020, which were considered optimistic at the time.

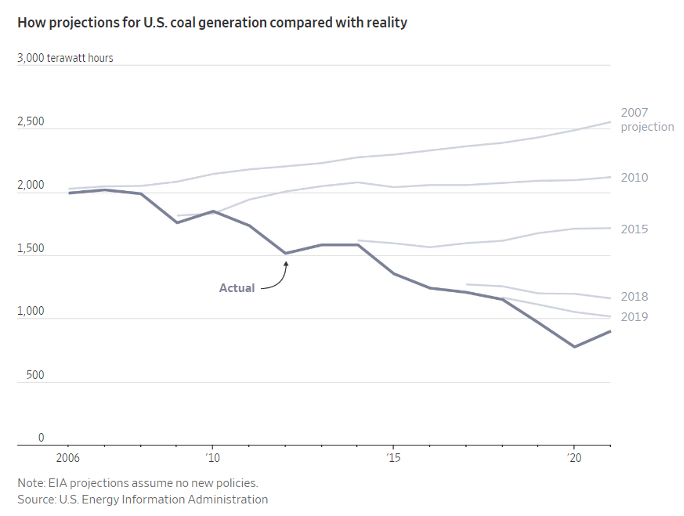

The most crucial goal of the energy transition has been to reduce reliance on fossil fuels, particularly oil and coal, which emit pollutants and excess CO2 into the atmosphere. The U.S. Energy Information Administration’s projections for U.S. coal generation since 2007 have consistently overstated actual usage as power generation moves away from coal.

Electric Vehicles Face Sales Slowdown, but Battery Costs Are Plummeting

Automakers have been facing a disappointing slowing in growth rate for electric vehicles, with E.V. sales increasing 49% through October this year, compared with 69% from the same period last year, according to Motor Intelligence. As a result, carmakers are cutting prices, slashing sales forecasts, and curtailing plans for assembly plants. However, battery costs continue to decline, which will benefit margins despite lower prices. According to The Information, the world is unexpectedly awash in battery-grade lithium and nickel, pushing down their prices 76% and 44%, respectively, year to date.

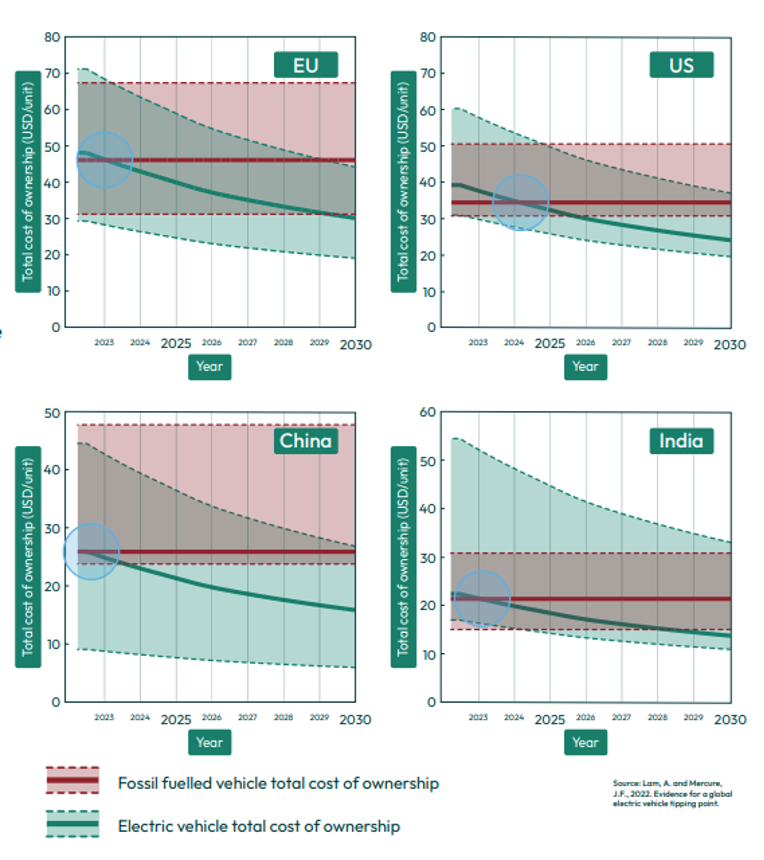

Already, the cost of electric vehicles has crossed the tipping point. According to a study by EEIST, electric cars are already cheaper than petrol and diesel cars in the E.U. and China. This tipping point is expected to be crossed in the U.S. in 2024. According to Wards Intelligence, electric and hybrid vehicles have increased to 16% of U.S. light-duty vehicle sales in 2023, compared with 12.3% in 2022 and 8.5% in 2021. While the limited availability (and reliability) of accessible charging stations remains a gating factor to broader adoption, there continues to be investment in building new infrastructure that should mitigate challenges over time.

Solar and Wind Power Costs Continue to Drop

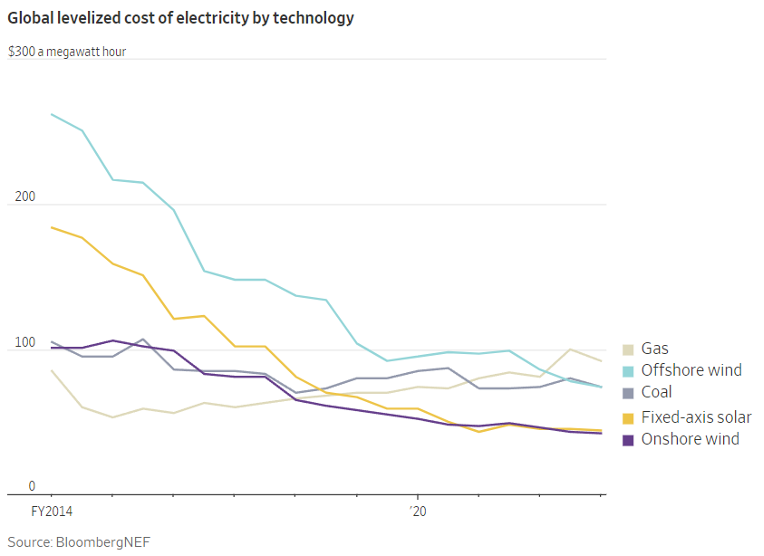

The average cost of solar power fell nearly 90% between 2009 and 2023, with onshore wind declining by two-thirds, according to BloombergNEF. In the past several years, the Levelized Cost of Energy (LCOE) of fixed-axis solar and onshore wind have declined and have become cheaper than gas and coal.

As we witness the remarkable decline in the costs of renewable energy, it's essential to recognize the driving forces behind this transformative trend. Technological advancements, economies of scale, and supportive policies have become the pillars that sustain and propel the renewable energy sector forward. At Momenta, our commitment remains unwavering as we channel our efforts toward supporting innovators and entrepreneurs dedicated to advancing energy efficiency, reliability, and cybersecurity within the dynamic digital industrial landscape. In embracing these advancements, we contribute to a sustainable future that extends far beyond the boundaries of today's achievements.

Momenta is the leading Industrial Impact venture capital + growth firm. We accelerate entrepreneurs and leaders devoted to the digitization of energy, manufacturing, smart spaces, and supply chains. Since 2012, our team of deep industry operators have made over 100 investments in entrepreneurs and helped scale over 150 industry leaders via our award-winning executive search and strategic advisory practices.