Momenta's Take: Industrial VC in 3Q23: Choppy but Promising Signs

Ken Forster

3Q23 Venture Spotlight: Conditions Choppy but Signs Favor Industrial VC

Venture funding continues to face the most challenging period in nearly two decades, as the ebullient sentiment of 2020–2021 faded on concerns over inflation, geopolitical uncertainties, higher energy prices, and elevated interest rates. While the methodologies used to track the sprawling landscape of private investments are widely used, what we are seeing broadly appears to be a stabilization following several quarters of decline.

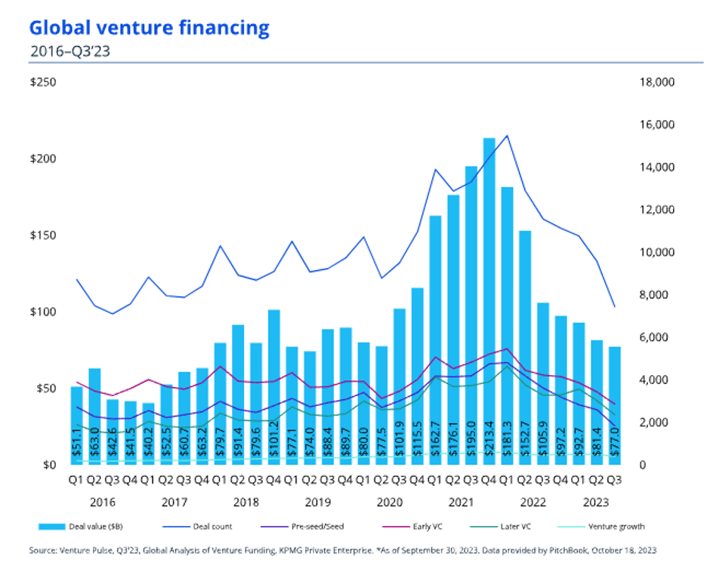

According to an analysis by KPMG, VC investment slowed to $77 billion across 7,435 deals, with global VC investment falling to a 16-year low during the 3rd quarter of 2023. Globally, the number of VC deals declined for the 7th consecutive quarter, and on a geographic basis, the Americas and Asia saw less investment, but Europe saw a slight rise in deal activity compared to the prior quarter.

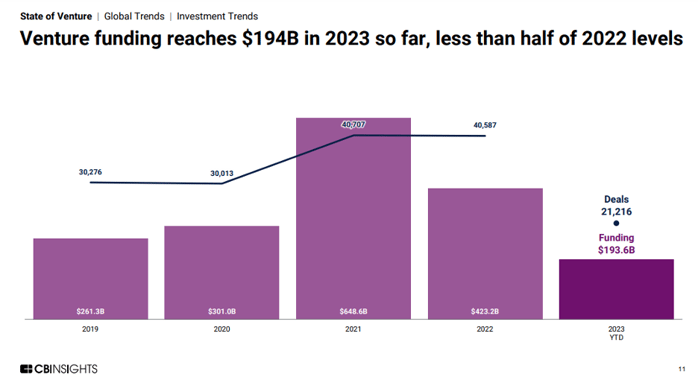

Crunchbase estimates VC funding of $73 billion increased slightly every quarter but declined 15% from the quarter a year prior. According to CB Insights’ data, 3Q23 venture funding increased from the prior quarter, up 11% to $64 billion, but total deal volume declined 11%. The picture for the full year paints a more dire context, with total funding in 2023 less than half of 2022 levels.

Signs of a Rebound in Early-Stage Venture

In the U.S., early-stage venture performance trended in a positive direction, according to Angellist, which offers founders reason for cautious optimism after several quarters of decline. Notable was an increase in investment activity, signaling a growing VC willingness to re-enter the market. An upward trend in median valuations among startups that secured funding provided clear evidence of an increase in demand.

A Shift Toward Funding the Industrial Transition to Clean Energy and Transportation

Within the challenging funding environment, there appears to be a palpable shift towards investments related to the transition to clean energy and transportation, away from media and consumer Internet startups. There were four mega-deals of over $100 million in the quarter, including a $997 million raise by battery recycler Redwood Materials and a $500 million raise by industrial automation platform Unway.

A recent report from PwC finds that climate technology outperformed other sectors of the economy, with investment declining roughly 40% over the prior year versus private investment across the economy declining 50%. Notably, the most significant change is seen in the industrial sector, which accounts for 34% of emissions, more than any other sector of the economy. Investors directed less than 8% of climate tech venture funding to industrials from 2013-3Q22, but since then, the share of investment into the industrial sector has almost doubled to 14% between Q4 2022 and Q3 2023.

Focus on First Principles, Looking Ahead

Maintaining a long-term perspective is foundational for venture investing. Many of the most successful global firms have their origins in difficult economic times, and the challenges of managing resources in adverse financing conditions test the mettle of burgeoning entrepreneurs. There remain significant challenges ahead. Regulatory uncertainty remains a paramount concern, especially in the context of sustainability and environmental regulations. Talent shortages, cybersecurity risks, and geopolitical tensions will continue to weigh on the medium-term outlook. For investors who piled into crypto and metaverse investments during the recent bubble, the path to sustainable returns will likely be rocky. There is growing skepticism that the optimism of Silicon Valley (evidenced by Marc Andreessen’s latest manifesto) is facing pushback, with growing calls to re-evaluate the value proposition of VC-driven models given the volatile returns over the past two decades.

At Momenta, our focus on digital industrial transformation is based on sustainable first principles rather than chasing transient trends. While financing conditions can be cyclical, opportunities to create long-term value continue to emerge. We continue to focus on innovators who apply cutting-edge technology and creative thinking to transform and disrupt how we make goods, transport, power, and feed our global future. If you are more interested in understanding why we call ourselves Venture Industrialists, check out our webinar.

Momenta is the leading Industrial Impact venture capital + growth firm. We accelerate entrepreneurs and leaders devoted to the digitization of energy, manufacturing, smart spaces, and supply chains. Since 2012, our team of deep industry operators have made over 100 investments in entrepreneurs and helped scale over 150 industry leaders via our award-winning executive search and strategic advisory practices.