Momenta's Take: String of Pearls

Ken Forster

String of Pearls –

Will Strategic M&A Make a Comeback?

After a period of declining activity accompanied by an increase in interest rates and challenging financial market conditions in 2022, strategic acquisitions are showing signs of a potential rebound.

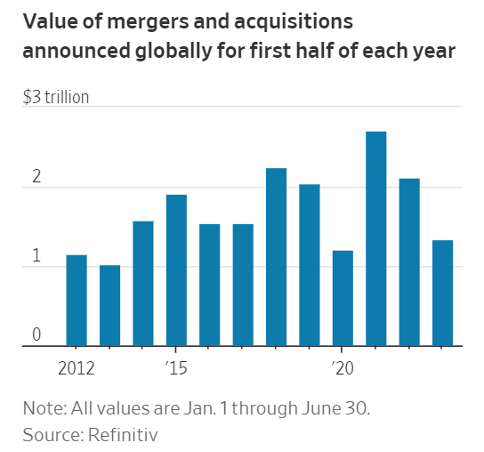

In the first six months of 2023, global companies announced deals worth $1.3 trillion, which is a 37% decrease compared to the previous year and the slowest first-half period since 2020, according to Refinitiv.

The surge in interest rates has led to increased costs for financial acquirers (Private Equity) seeking to purchase businesses, while the prolonged boom in private companies and publicly traded stock valuations has raised expectations for potential sellers. With debt pricing surging over 7% in 1Q23, acquisitions have become more expensive, negatively impacting ROI. Lenders are imposing stricter borrowing requirements, and buyer due diligence costs are rising.

Elevated interest rates escalate the cost of capital and can reduce business valuation. Pricing has emerged as a key sticking point. During the latter part of 2022, sellers frequently held unrealistically high price expectations; however, economic headwinds have shifted buyers' focus to seek bargains, resulting in more noticeable discrepancies in deal valuations.

Tough Times Make for Good Value Opportunities

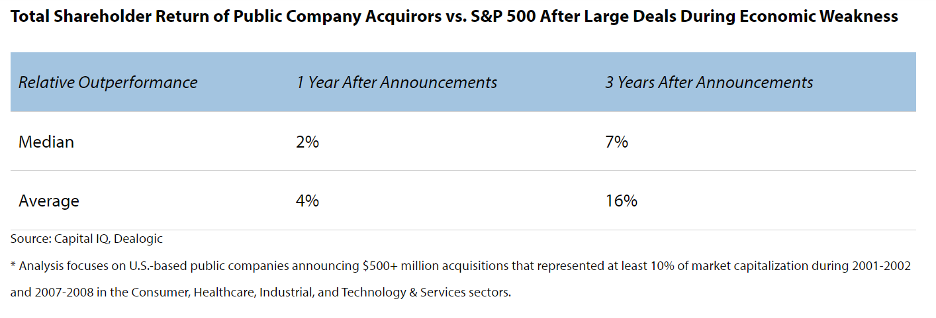

Periods of macroeconomic difficulty can provide opportunities for above-average value creation for publicly traded firms. RW Baird's analysis of the 1-year and 3-year stock performance of publicly traded companies following large M&A announcements during periods of GDP weakness evidences potential for outsized returns (exceeding the performance of the S&P 500) following acquisitions.

Already Flush with Cash, Stock Market Rebound Arms Strategics with Currency for M&A

For strategic (corporate) buyers, M&A plays an essential role in fostering innovation and economic growth, and publicly traded firms benefit from stronger financial markets where they can use stock as a currency. The S&P 500 has gained 17% this year, including a 3.1% increase in July, adding more "dry powder" to the estimated cash sitting on balance sheets (which is approaching $2 trillion for U.S. listed, non-financial companies). Firms with strong balance sheets and solid M&A processes likely have a competitive advantage in the current market. They have cash and the ability to extract synergies while moving quickly to make acquisitions while a tough financing environment is reducing competition from buyers see "green shoots" for increased activity later this year, but the window of opportunity may be limited.

The Benefits of Strategic M&A (Particularly Tech)

For strategic acquirers, value creation opportunities extend beyond the financial considerations that guide Private Equity buyers. Of course, any M&A integration process will consider back-office consolidation and reduction of redundancies as a way to cut costs. However, for strategic buyers, M&A can boost growth, competitive advantages, and innovation and reduce risks in a few key ways, including:

- Access to New Technologies: Strategic acquisitions can jump-start access to cutting-edge technologies and intellectual property that would otherwise cost significant time and resources to develop.

- Accelerating Growth: Acquired businesses can help enhance and complement organic revenue and market share growth.

- Competitive Advantage: M&A can boost competitive edge by combining two companies' complementary strengths. For instance, a company with a strong R&D department might acquire a company with excellent marketing capabilities, creating a powerful combination.

- Expansion of Markets and Geographic Reach: Acquisitions can establish or strengthen presence in new geographic regions or market segments. Expansion can diversify revenue streams and reduce reliance on single markets.

- Enhanced Innovation: Well-sourced M&A (such as "acqui-hires" that are more focused on talent rather than revenue) can add talent and intellectual firepower to the business. Done right, enhanced collaboration can boost creativity and productivity.

- Risk Diversification: Diversifying a product or service portfolio through M&A can help a company reduce exposure to risks associated with a reliance on single products or markets.

With the 2023 stock market recovery in progress and interest rate hikes approaching their peak, strategic acquirers find themselves in a favorable position to move swiftly and seize unique assets. The reduced competition from financial acquirers provides them with a golden opportunity to make strategic acquisitions and bolster their market position for the future. This agility in the acquisition landscape can be a game-changer, enabling strategic players to capitalize on valuable opportunities and drive long-term growth.

Momenta is the leading Industrial Impact venture capital + growth firm. We accelerate entrepreneurs and leaders devoted to the digitization of energy, manufacturing, smart spaces, and supply chains. Since 2012, our team of deep industry operators have made over 100 investments in entrepreneurs and helped scale over 150 industry leaders via our award-winning executive search and strategic advisory practices.