Momenta's Take: The Politics of AI Investing

Ken Forster

The Politics of AI Investing:

China Investments Drawing Greater Scrutiny

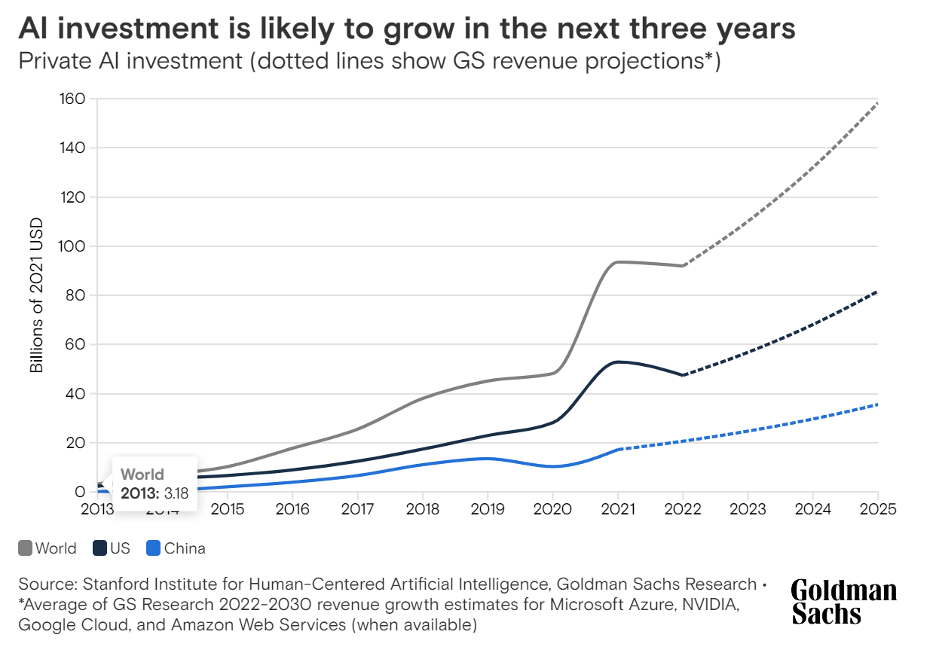

Artificial Intelligence has seen a massive inflow of investments from governments, corporations, and Venture Capital firms in recent years. The IDC estimated that global spending on AI including software, hardware, and services for AI-centric systems would increase by 26.9% to $154 billion in 2023.

Goldman Sachs forecasts total investment in AI reaching $200 billion by 2025. With China emerging as one of the most active countries for research and startups, there is increasing scrutiny around the geopolitical sensitivities relating to how foreign investments in Chinese technology firms may be used to support human rights violations and advance potential military threats.

Recent US Congress hearings on VC investment in Chinese companies has highlighted concerns around technology, national security, and economic interests. The House Select Congressional Committee on Strategic Competition between the US and the Chinese Communist Party recently released a new investigation that was initially disclosed last year, detailing how five VC firms had in aggregate invested $3 billion in critical technologies. The panel identified $1.9 billion in Chinese AI companies that support the CCP’s human rights abuses and military, plus at least $1.2 billion in China’s semiconductor sector said to advance “the CCP’s military, genocidal, and techno-totalitarian ambitions." The committee noted that investments have gone into companies that “support the PRC’s military, digital authoritarianism, and efforts to develop technological supremacy and undermine American technological leaders”. The committee called upon the Biden administration to restrict US investment in Chinese firms sanctioned by the US government due to ties to China’s military or repression of minorities and expand US curbs on investment in China to additional sectors.

New Regulatory Pressure Reduces China Investments

Technology is a focus of sensitivity to safeguard national security concerns. Tools of policy include restrictions on exports of technology, reviews of cross-border M&A by the Committee for Foreign Investment in the United States (CFIUS), and increasing scrutiny of VC investments. In 2022, the US Department of Commerce implemented new rules aimed at restricting China’s ability to obtain advanced computing chips, develop and maintain supercomputers, and manufacture advanced semiconductors. Last year, the administration rolled out plans to increase penalties and increase enforcement against companies that mishandle restricted technology and fail to comply with export restrictions.

As a result of the heightened scrutiny and regulatory pressures, US venture capital investment into China declined by over 80% in 2023 according to data from PitchBook. In 2Q23, Chinese deals involving a US VC investor were about $200 million, compared with $2.4 billion in 2022 and $3.8 billion in 2019. The increased trade curbs have drawn pushback from investors and companies such as NVIDIA, which views new restrictions as causing a permanent loss of economic opportunities.

The Center for Strategic and International Studies, while noting the strategic necessity of some curbs, highlights unintended consequences from technology restrictions including loss of human capital from immigrants and foreign nationals of countries subject to export controls, potential loss of market share, additional needs to re-route supply chains, and loss of domestic business opportunities.

Make Sure to Keep an Eye on Regulations

Investors should ensure familiarity with US export regulations and restrictions, and be aware of the types of technologies that are subject to restrictions, as well as the potential economic impact. More broadly, businesses and investors should be aware of the categories of technologies where there could be risks from increased regulatory controls, including:

- Dual-Use Technologies: These are technologies that have both civilian and military applications. Examples include advanced materials, aerospace technologies, and certain types of electronics. Investments in startups developing dual-use technologies could create concerns that technologies could be diverted for military purposes or used to enhance the capabilities of potential adversaries.

- Critical Infrastructure Technologies: Technologies that support vital infrastructure sectors such as energy, telecommunications, transportation, and healthcare can be categorized as sensitive from a national security perspective. Investments in startups that develop technologies that could potentially compromise the security, reliability, or resilience of critical infrastructure could pose significant risks.

- Cybersecurity and Information Technology: Startups developing encryption technologies, network infrastructure, or data analytics tools could be subject to particular scrutiny due to the risk that these technologies could be exploited for espionage, data theft, or disruption of critical systems.

- Advanced Manufacturing: Technologies such as 3D printing, robotics, and nanotechnology play a key role in industries crucial for national defense and economic security. Investments in startups in these sectors could raise concerns if there's a risk of sensitive manufacturing techniques or intellectual property being transferred to adversarial nations.

- Biotechnology and Health Sciences: Innovations in biotechnology, pharmaceuticals, and medical devices have significant implications for national security, particularly in areas such as biodefense, pandemic preparedness, and biosecurity. Cutting-edge medical treatments, genetic engineering technologies, or biological agents could be considered security risks because of potential misuse or diversion.

Global innovation relies on the role of VC funding to foster research in emerging technologies and promising startups. For technologies such as AI, cybersecurity, infrastructure, advanced manufacturing, and other categories where geopolitical adversaries could leverage against national interests, venture investors need to be aware of the regulatory guardrails and potential risks that extend beyond noncompliance. While the “genie may be out of the bottle” in many respects as it relates to AI, the heightened sensitivities and more stringent enforcement at hand should inform investors’ strategy, focus, and due diligence to minimize investment risks.

Momenta is the leading Industrial Impact venture capital firm, accelerating digital innovators across energy, manufacturing, smart spaces, and supply chain. For over a decade, our team of deep industry operators has helped scale industry leaders and innovators to improve critical industries, the environment, and people's quality of life.