Momenta's Take: Ready for M&A Resurgence 2024.

Ken Forster

M&A Poised for a 2024 Rebound: Are You Ready?

Is Your Business Set for the 2024 M&A Rebound?

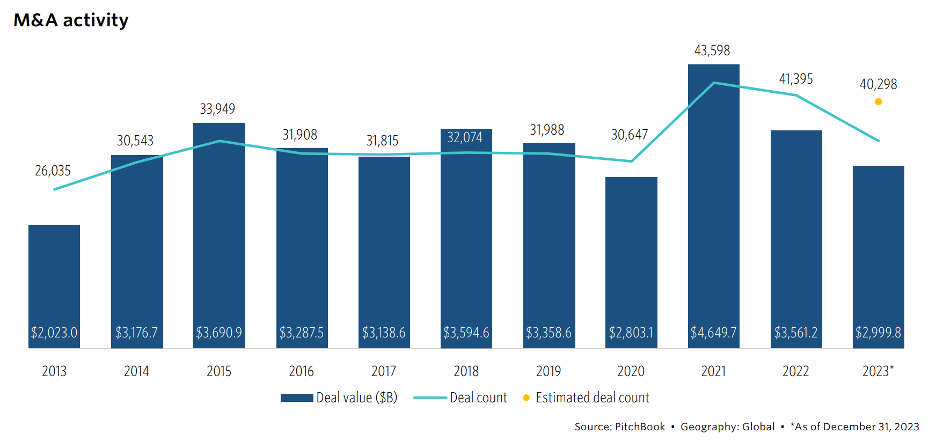

The global market for Mergers and Acquisitions (M&A) had its second-worst year in a decade in 2023, but in 2024, conditions are setting up for a rebound. According to an analysis by PitchBook, the $3 trillion total value of deals closed or announced in 2023 declined 15.8% from 2022, representing a deceleration from the 23.5% decline the previous year. Since the all-time peak in 2021, global M&A value is now down 35.5%.

The U.S. Federal Reserve’s decision to dramatically increase interest rates in March 2022 to tame inflation was the catalyst for the slowdown in deal activity, as the combination of higher borrowing costs, slower economic activity, growing geopolitical uncertainty, and the decline in equity market valuations created significant headwinds for both buyers and sellers.

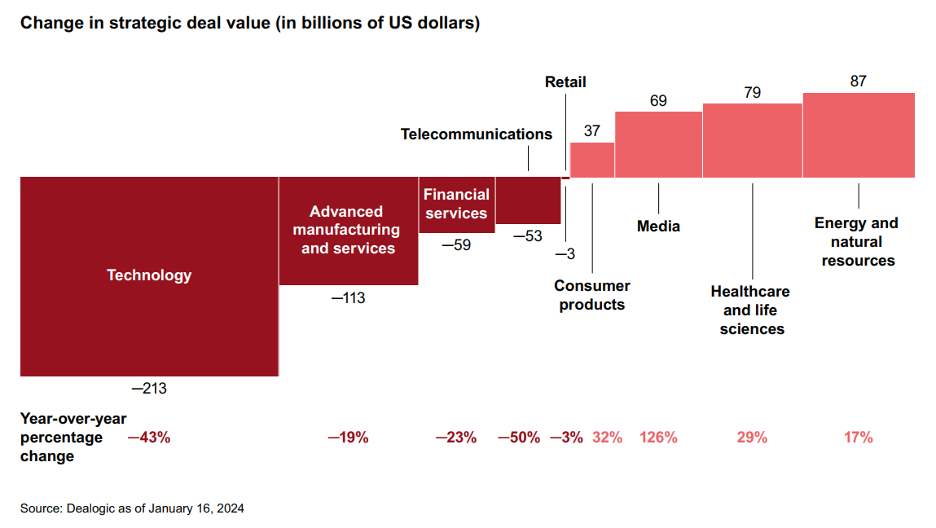

According to an analysis by Bain, strategic M&A declined by 6% in 2023, and the biggest obstacle was buyers and sellers struggling to close the gap in valuations. Private equity exits declined 44% in value and 22% in volume in 2023. Deal activity also differed across sectors. While tech saw the greatest declines, healthcare, energy, and natural resources activity showed particular strength.

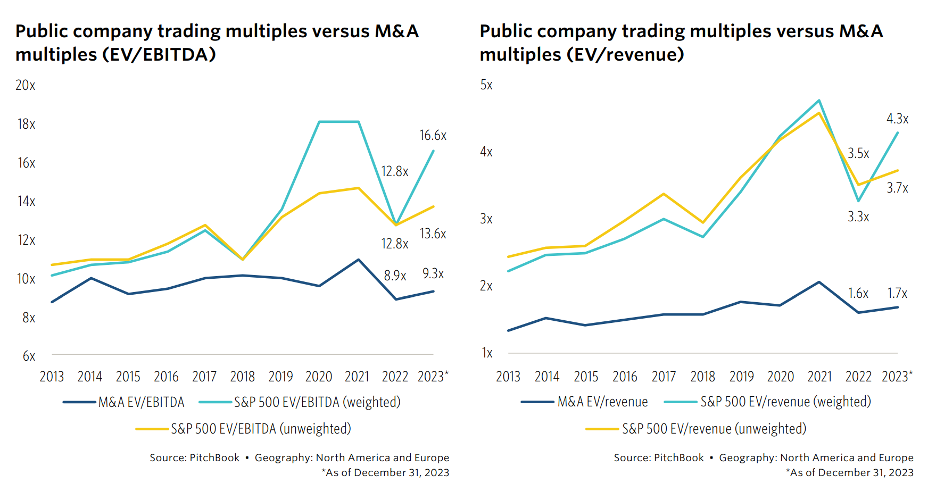

Public Market Rebounds Ahead of M&A

It’s uncertain that 2024 will not see a third consecutive yearly decline in M&A, but signals point to a pending recovery ahead. Most noteworthy has been the rebound in public company valuations toward the end of 2023. According to Bain, the valuation gap is the biggest obstacle to dealmaking. Strategic deal multiples were the lowest in 15 years, fueling buyer skepticism of aggressively priced assets. On the flip side, the recovery in public equity markets contributed to the widening gap between public and private market valuations, leading many potential sellers to hold onto assets pending more favorable valuations.

Factors Setting Up a Rebound

Several factors are setting up an acceleration in M&A. One main driver will be the U.S. Fed’s expected commencement of rate cuts as inflation recedes. At the January 31 meeting, the Fed signaled that rate cuts were less likely in March, but the market expects cuts to begin by at least mid-year. The gap between public and private company valuations could create more willingness on the part of buyers to pay higher M&A multiples. In contrast, more attractive equity market valuations could help open the window for IPOs again. Private equity funds currently have a record $2.5 trillion in “dry powder." As many funds near their ten-year lifecycles, they will be incentivized to sell assets more quickly.

Decision Maker Sentiment Leans Toward Recovery in 2024

A survey by KPMG found that 65% of M&A decision makers expect more dealmaking in 2024, with 70% saying they are currently working on a deal, with a majority expecting to do a deal in the first half of the year. EY-Parthenon’s CEO Outlook Survey found that 52% of U.S. CEOs are planning M&A deals, higher than the 35% in a global survey, which found only 35% planning deals with 58% of CEOs planning to divest an asset in the coming year. The EY-Parthenon Deal Barometer anticipates a 13% increase in P.E. deal volume and a 12% increase in corporate deal volume in 2024, representing a return to pre-pandemic levels. Deloitte’s 2024 M&A survey found that 79% of corporate leaders and 86% of private equity leaders expect an increase in deal volume over the next 12 months.

What to Expect in 2024

With sentiment trending optimistic for the coming year, there are a few trends worth tracking. One is the shift away from tech deals toward “older” sectors, particularly energy and natural resources. With $3 trillion of renewable energy investments forecast over the next decade, M&A will play a critical role. Generative AI is expected to figure prominently in M&A processes in the future. A KPMG survey found that 53% currently use Generative AI in the M&A process, with 71% planning to use the technology for deal structuring and 51% using it for deal strategy. Bain sees dealmaking's data collection and synthesis elements becoming remarkably compressed and commoditized, which elevates the importance of mastering integration's mechanics and cultural aspects.

At Momenta we believe that a rebound in M&A activity is likely to impact Digital Industrial firms, particularly as strategic acquirers seek growth and competitive advantage through tactical acquisitions. With the more stringent regulatory environment extending closing cycles for “mega-deals,” expect acquirers to use more cash and equity to fund acquisitions smaller in scope. For private firms looking for potential exits, ensuring that business models are straightforward and operations are transparent before M&A heats up is essential.

Momenta is the leading Industrial Impact venture capital firm, accelerating digital innovators across energy, manufacturing, smart spaces, and supply chain. For over a decade, our team of deep industry operators has helped scale industry leaders and innovators to improve critical industries, the environment, and people's quality of life.