Value Vector

Successful Structuring, Development & Management of IoT Partner Ecosystem: Part 2

Jesse DeMesa

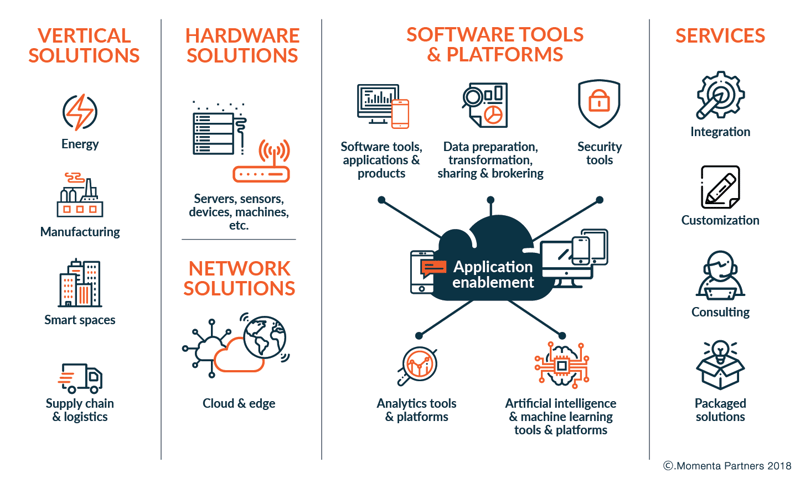

The emerging IoT space can only evolve, succeed and grow if it can deliver on the promise of transforming businesses, creating new opportunities, and driving incremental value. Part 1 of our article focused on key challenges faced in IoT, the importance of partner ecosystems, and how clarity in strategy and positioning facilitates success with partners. The components that make up an IoT Solution or Service can be summarized in this image:

The components that make up an IoT solution or service

Partner Categories

Once clarity around strategy and positioning is achieved, partner categories and selection criteria can be defined, programs can be developed, and the process of recruiting partners can begin. Partner program categories could include the following:

- Value Added Reseller (VAR): Resells the company’s offering, often in locations or markets where the company does not have a presence, while adding some type of incremental value. Establishing VARs in foreign markets often requires a major investment on both sides, which may include recreating some internal processes of the company, in addition to providing training and a range of support services.

- Solution Provider: Packages the company’s offering as a component of a complete solution that may be delivered, implemented, and supported partially, or in whole, by the Solution Provider.

- Solution-as-a-Service: A variant of the Solution Provider category, a partner could leverage your offering as part of a cloud-based service that is offered to multiple end customers in a specific industry or vertical market. This could be viewed as a partner sale or a direct customer sale. The commercial model will also need to be considered. If the partner is offering a service with a monthly subscription charge, you may want to consider aligning to that commercial model as a way of sharing risk and reward and simplifying the execution of the partnership.

- System Integrator (SI): Partners certified to provide implementation, integration, and consulting services around a company’s offering. This will require training and, depending on the offering, a program to certify the capability of the partner. Selection of SI partners may often be heavily influenced by the end customer who may have preferred partners. Thus, having a strong position with a strategic end customer is important as you don’t want to have partners forced on you. It also enables a stronger negotiating position with the SI partner as you may want them to pay for training, introduce you into their accounts, and promote your company and offering at events and through press announcements. Depending on the SI, the offering and the structure of the partnership, a traditional SI may also fall into the Solution Provider or Solution-as-a-Service category.

- Component Partners: Companies that have intellectual property such as a sensor, device, software, or system that is integrated in a packaged form with your company’s offering and certified. This category may incorporate a larger volume of partners with more structured program management. Although not typically considered strategic, these partners can be very helpful in enabling a total solution, promoting your company and offering, and generating qualified leads.

- Embedded or OEM: Companies who want to embed and white label into a broader product or solution offering that they, the partner, bring to market. These partnerships are typically strategic and require dedicated programs customized for the specific partner and opportunity. In this type of partnership, a partner may request exclusivity or some form of protection from competition. Exclusivity has implications to your entire business and should only be considered on rare occasions. Any consideration of exclusivity or a protected time runway should require a business plan and forecast with minimum revenue commitments that must be met if exclusivity is to be retained. Keep in mind that partners who fall into this category can often become strategic investors and acquirers.

The evolution of IoT is forcing many companies to transform and challenge their roles and positions. Companies that may have traditionally fit into one category may now be in another, or they may straddle multiple categories. Companies that have been partners may now be competitors. For example, in the Smart Agriculture space, farming equipment companies and seed companies have become solution providers, offering a range of different product and cloud-based service offerings to farmers. Telecom operators, SIs, and equipment suppliers, who traditionally were partners, may now compete to deliver a range of vertical solutions and services while simultaneously offering their own component technologies and products. Building a successful partner ecosystem requires an understanding of not only how a potential partner is positioned today, but how that partner’s strategy will evolve moving forward.

Strategic versus Tactical

Partners or customers that present large opportunities and require major investments of time, resources, and money to recruit and develop are considered strategic. Recruiting and managing strategic accounts requires the generation of a dynamic plan. This plan needs to include:

- Objectives,

- An analysis of strengths and weaknesses,

- Strategy,

- Actions that support the strategy and enable achievement of the objectives.

Strategic partners require your engagement of their sales channel to capture mindshare and drive results. The alternative to active management is being in a partner’s ‘catalog’ and praying for results. In my experience, these prayers are rarely answered. The goal for any strategic partner or customer is ownership- standardization and 100 percent deployment and mindshare for your offering. Strategic accounts are typically large and difficult to navigate with multiple influencers at different levels of the organization. Breaking into the account is challenging, account ownership presents an even higher degree of difficulty.

Companies must choose wisely when selecting and engaging strategic partner targets.

The development and management of these accounts is costly and time consuming. A significant investment of time and resources is required to ensure success. Qualifying targets are critical before making major resource investments. I have seen companies spread themselves thin by chasing too many strategic targets and then ultimately failing because they are unable to properly develop and capture the mindshare of the partner. I have also witnessed strategic partner recruitments that consist of endless ‘great’ meetings, consuming time and resources, and leading nowhere.

Tactical partners, conversely, are typically managed under a common group program that is administered by a program head and support team. There will typically be a greater volume of tactical partners who individually do not justify dedicated resources and management.

Partner Promotion

Once a partner program has been architected and partners have been recruited, you will want to promote your partner ecosystem and have your partners promote you and your company’s offering. There are multiple avenues to drive promotion of your ecosystem which will ultimately help propel the growth of the partner ecosystem and your company.

Opportunities include:

- Shows and events,

- Analyst meetings,

- Press releases,

- Podcasts,

- Speaking engagements.

A creative way to promote your ecosystem is to set up a ‘Marketplace’ on your website to promote the capabilities and offerings of your ecosystem. Companies often extend this beyond simple promotion by providing a vehicle from which the partner’s offering can be accessed and even purchased from your website.

A Successful IoT Partner Ecosystem Example

A few years ago, I led the team that architected and developed a partner ecosystem for an early IoT pioneer who created a disruptive application enablement software platform. When the company was formed, and the platform concept was hatched, IoT was not even a term. To gain traction in the market, our team had to be very clear in positioning our offering, ensuring that it was promoted in the context of an emerging space and the other components required to enable a total solution and deliver value.

We defined an application enablement platform as software tools that could be offered to third parties who could build applications and solutions without our involvement. Based on this strategy and our go to market model, we required a range of partners to complement our offering, complete a total solution, and deliver on the value proposition associated with a particular solution or cloud-based service.

How achieved our partner ecosystem:

- We defined the partner categories and programs we required and began the process of recruiting.

- Simultaneously, with a direct sales and business development organization, we focused on early adopter end customers who had the in-house capability to build out solutions and services on our platform that they would consume internally. These customer targets were the solution provider, SI, and end customer all wrapped up into one.

- We leveraged our own applications engineering team to work with these initial customers, supporting the development and deployment of their initial applications and solutions, ensuring success, and providing feedback to the software platform development team. We never developed our own applications or solutions as this would have competed with partners and diluted our focus.

- Establishment of clear positioning and boundaries facilitated our ability to drive partner relationships as we were never viewed as a threat. Our early customers became our initial references and not only helped us recruit additional customers that fit our early customer profile, but also new partners.

As we recruited complementary partners, we began to realize the benefits obtained from leveraging our ecosystem. We understood that we were in a race and our goal wasn’t to simply stay ahead, but to extend our lead. Our partners showcased our offering through their own applications, solutions, press announcements and events. They provided us with qualified customer leads, access to their sales channels and partners (which led to more leads and partners), references, and testimonials. The network effect and leverage obtained from the partner ecosystem created a disproportionate perception of the size and influence of our company in the market. This ultimately played a key role in the acquisition of the company.

Conclusion

A successful IoT partner ecosystem complements and supplements your business, driving growth. It creates an outsized perception of your company in the market, pulling new partners into the ecosystem orbit and driving incremental customer opportunities. In the emerging IoT space, speed and leverage are a winning hand. A successful partner program allows your company to focus on what makes you unique and special, rapidly innovating around your core intellectual property, while simultaneously leveraging the components and professional services necessary to deliver total solutions and services to end customers.

Drowning in hype cycles and statistics about IoT, blockchain and Connected Industry? Momenta Partners takes a fresh look at the challenges confronting industry through a series of thought pieces: podcasts, webinars, blog posts and whitepapers. Learn how our industry insights can help grow your business.