Momenta's Take: Battery Shakeout

Ken Forster

Battery Shakeout: Speed Bump or Imminent Consolidation?

2023 was a year that saw broad progress in the adoption of clean energy technologies, as falling costs of renewables attracted interest and a record $358 billion investment in 1H23. According to research from RMI, solar and wind are already the cheapest forms of new energy for 85% of the world. Did you know that the number of electric cars on the road is increasing rapidly? In 2019, only 1 out of 25 new cars were electric. However, experts predict that by 2023, 1 in 5 new cars will be electric.

Join the growing number of environmentally conscious drivers and make the switch to an electric car today! Batteries are crucial components in electric vehicles and are instrumental in driving the widespread adoption of clean energy. The industry has witnessed a significant influx of investments in both startups and manufacturing capabilities in recent years, all aimed at meeting the growing demand for electric vehicles and renewable energy technologies.

The industry's growth, particularly for lithium-ion (Li-ion) batteries, commonly used for EVs, is significant. A 2022 analysis by the McKinsey Battery Insights team forecasts the Li-ion battery chain (from mining through recycling) to grow at over 30% annually from 2022 to reach a market size of $400 billion by 2030.

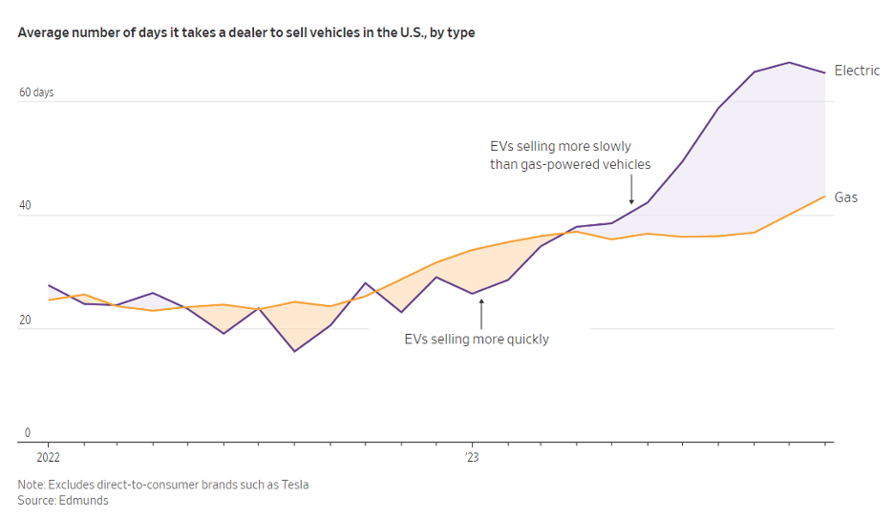

Despite the favorable long-term trends, the broader transition has not been without challenges. Most recently, major automakers have had to scale back forecasts for EVs based on lower-than-expected demand, while battery makers have had to wrestle with overcapacity and low prices.

Established automakers have had to scale back their ambitions for the EV transition in recent months. Ford announced a pause on $12bn in EV investments and pausing work on BlueOval Battery Park, a $3.5bn project supported by $1.7bn in taxpayer money and tax abatements. General Motors announced indefinite layoffs of workers across two plants with Bolt EV and EUV production ending, and is delaying the opening of a large electric pickup truck factory.

Prices for battery metals, including lithium, cobalt, and nickel, declined in 2023, which helped to drive down pricing for batteries used in electric vehicles. However, weak demand for EVs and falling prices have impacted revenues and profitability for battery companies, resulting in widespread layoffs and scaled-back plans for expanding manufacturing capacity.

Downsizing - for the Moment?

There have been widespread layoffs and restructurings across battery, EV, and green energy companies recently. A few examples:

- Solar and battery-system supplier Enphase Energy announced the downsizing of both its manufacturing facilities and workforce.

- LG Energy Solutions announced 170 job cuts to its Holland, MI, plant just two years after receiving $170 million in state incentives intended to create 1,200 jobs. SK On plans to furlough an undisclosed number of workers at its battery plant in Jackson County, GA.

- Silicon battery developer Enovix laid off 185 engineers and staff at its Fremont, CA, factory, shifting most operations to Asia.

- Panasonic dropped plans to build a multi-billion-dollar EV battery factory in Oklahoma.

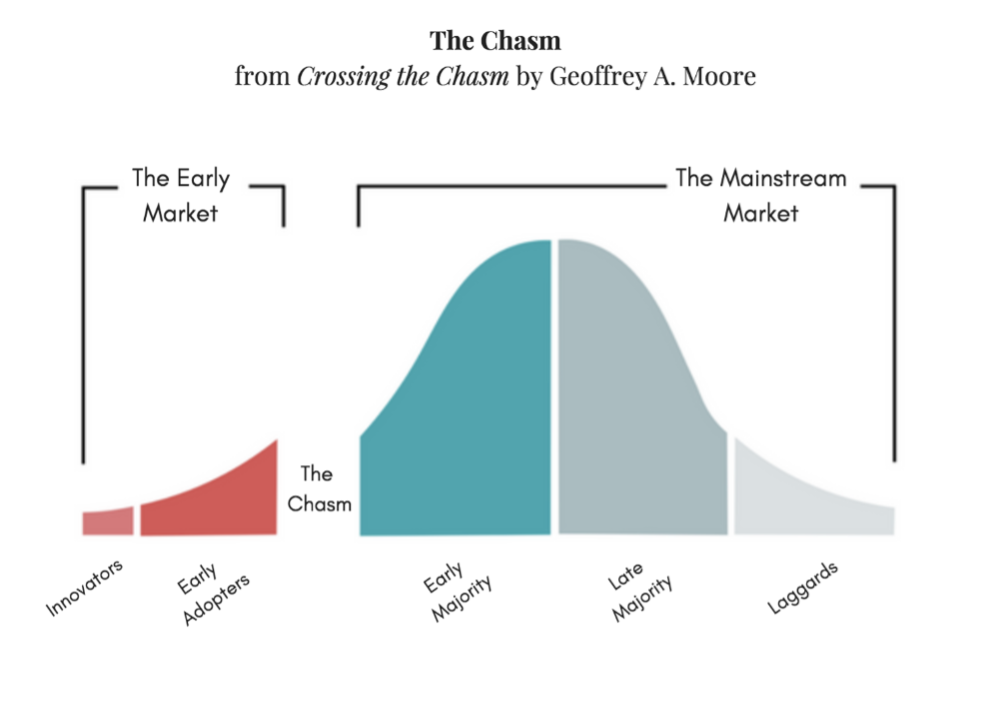

Crossing the Chasm

It's not uncommon for new technologies to undergo boom-bust-consolidation cycles. It's more the rule than the exception. The combination of government incentives, increasingly attractive cost curves, and highly visible successes (Tesla most notably) attracted a wave of capital to fund scores of battery startups to address growing demand not just from EVs but also for other connected devices, as well as utility-scale storage (which is so critical to offset intermittent generation from wind and solar). Author Geoffrey Moore outlined new technologies' risks in gaining market acceptance in his 1991 book "Crossing the Chasm."

Thinning the Herd to Make the Industry Stronger

It's reasonable to assume that the battery industry will see a wave of consolidation in the near future. The EV industry has already seen a significant shakeout since Tesla kicked off the U.S. EV industry in 2008 with the launch of the Roadster, this saw close to 50 startups formed in the U.S. and Europe. Half of these are either bankrupt or never became viable. China is already further down the road than the West. The EV industry in China has already seen the number of EV and plug-in hybrid car companies contract by 80% since 2019 to around 100 today. In 2017, there were 200 registered Chinese battery companies competing for the EV business; now, just 10 companies account for 98% of Chinese EV batteries.

With so much capital poured into battery technology startups, it's not surprising that a market slowdown would create problems in this highly capital-intensive industry. Rising interest rates and scaled-back demand from EV manufacturers portend difficult times ahead for many firms. However, the combination of favorable long-term secular trends, regulatory support and incentives, and innovative new approaches points to an exciting, if turbulent, time ahead for the industry.

Momenta is the leading Industrial Impact venture capital + growth firm. We accelerate entrepreneurs and leaders devoted to the digitization of energy, manufacturing, smart spaces, and supply chains. Since 2012, our team of deep industry operators have made over 100 investments in entrepreneurs and helped scale over 150 industry leaders via our award-winning executive search and strategic advisory practices.