Value Vector

Who will win the race for the leading LPWAN protocol?

Sandra Mueller

Who are the main players?

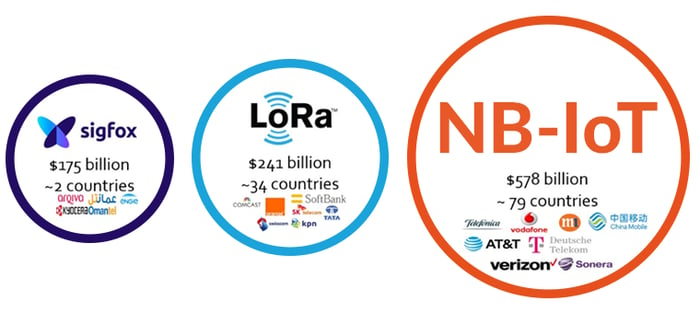

There have been three equally matched types of protocols in the LPWAN market:

- Protocols that also operate the Ultra Narrow Band Radio in the unlicensed spectrum, such as Sigfox and Ingenu

- Protocols that operate in the unlicensed spectrum, best represented by LoRa technology

- Protocols that operate in the licensed spectrum, such as NB-IoT (supported by the 3GPP)

Prior to their inception, companies who wanted to connect things like water meters or smoke alarms to the internet had to buy cellular modems that cost $50+ as well as manage the paperwork of monthly service fees. By comparison, LPWAN are all well suited for connecting low-cost, remote wireless sensors to fuel the growth of IoT devices.

Image source: Lux research

Sigfox is a French company with a proprietary system that claims to be rolling out networks in over 40 countries. In France alone they claim to have already covered about 92% of the country's population with as few as 1,500 base stations. They arguably had a head start in the LPWAN race. They are involved in some interesting IoT use cases including the tracking of rhinos in remote African areas. and their partnership with WND in the UK.

LoRa/LoRaWAN continually expanding The Things Network. LoRa can be considered a more "open" system whose supporters include French operators Orange and Bouygues Telecom. LoRaWAN supporters KPN, and SK Telecom. An advantage of LoRa is that it operates independently of mobile operators in areas that are hard to reach for telecom carriers such as industrial and agricultural applications. Further, its separation from telecom carriers makes it persuasive to those focuses on data protection such as a private IoT lab.

NB-IoT is something of a media darling and has lots of fans including Huawei, Deutsche Telekom, and Qualcomm. They've also been involved in tracking seals in Scotland. Research by lux research suggests that by 2022, NB-IoT will likely capture over 90% of the LPWAN connections globally, trouncing rival standards Sigfox and LoRaWAN on the strength of its wider coverage and reliability. They also assert that LoRaWAN is likely to complement NB-IoT in niche cases, and 5G is unlikely to disrupt the LPWAN space until at least 2028.

Amongst Lux's other findings:

- LoRaWAN has niche use cases. The LoRaWAN standard has an edge in niche cases. It is the only system with built-in GPS-like technology and can be used to build shared community networks. Mobile network operators are deploying it or considering dual deployment along with NB-IoT.

- Sigfox's early lead is fragile. Sigfox's only advantage is its lead in network deployments, mainly in Europe, and these existing uses are the main reason why solution providers choose it today. However, as LPWAN competition like NB-IoT grows, Sigfox's advantage will begin to erode.

- 5G will be hit by delays and costs. Fifth-generation mobile technology, or 5G, won't disrupt the LPWAN space any time soon. LTE and LTE-A wide-scale coverage began only two years to three years after standardizations were set, and it is likely that 5G will face the same fate or even longer, with standardized and full stack deployments beginning in 2022. High costs are another deterrent.

The sticking points

Lora, Sigfox and other solutions that operate in unlicensed spectrum bands, are incompatible with each other. Even when you include the licensed options, no particular IoT technology can be a “one size fits all” solution, means different options in interoperability are imperative, and the lack of market consolidation is a significant barrier to market dominance. Further, it's not easy for consumers, carriers, and OEMs to distinguish between the different vendor options. Over the last couple of years no one has come out of the battle unscathed. In particular, we've seen growing pains within both Sigfox and ingenu senior management.

Ultimately, the is no one winning solution for every device, manufacturer or IoT company. What impact will the lack of interoperability have with competing ecosystems? Will licensed vs unlicensed become a barrier to future evolution? Which solution will be the most cost-effective across multiple regions, countries and use cases?

Want to learn more? Please join Momenta Partners for a webinar exploring LPWAN technologies, their use cases and the market opportunity with Ed Maguire and special guests: "Connecting the world at large: Exploring LPWAN technologies and opportunities."

Drowning in hype cycles and statistics about IoT, blockchain and Connected Industry? Momenta Partners takes a fresh look at the challenges confronting industry through a series of thought pieces: podcasts, webinars, blog posts and whitepapers. Learn how our industry insights can help grow your business.